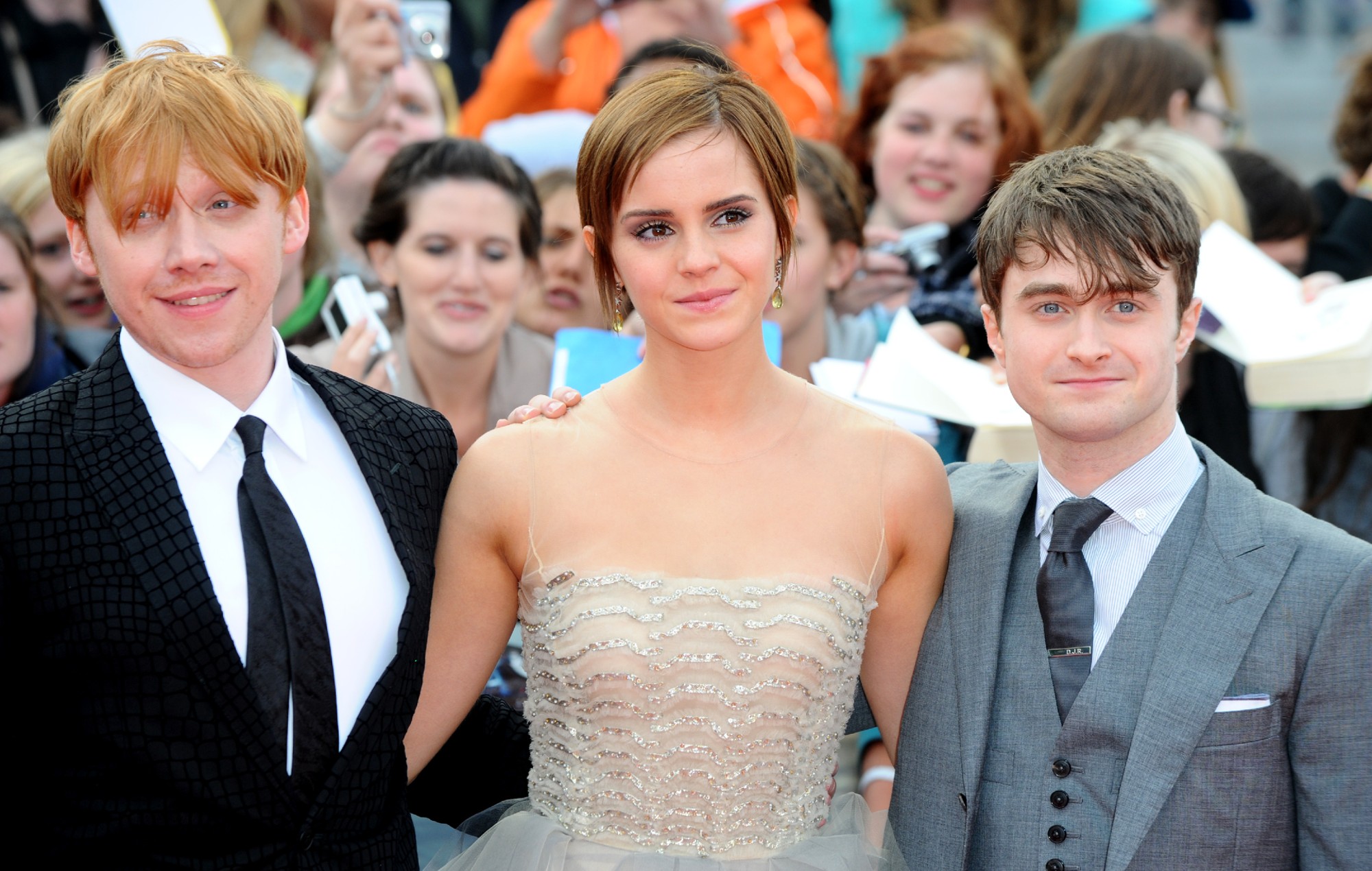

‘Harry Potter’ star Rupert Grint ordered to pay £1.8m after losing tax dispute

Harry Potter star Rupert Grint has been ordered to pay £1.8million in tax after losing a legal dispute with HM Revenue & Customs.

The actor, who starred as Ron Weasley in all eight films, was originally told to pay the sum in 2019 after an HMRC investigation disputed one of his tax returns.

Grint’s lawyers launched an appeal, arguing that money he received from a company had been correctly taxed as a capital asset, but HMRC said it should have been taxed as income at a higher rate.

As reported by the BBC, Grint’s claim has been dismissed by a tax tribunal judge and he will now have to pay a total fee of £1.8million.

During the 2011-2012 tax year, Grint received £4.5million from a company that managed his business, and for which he was the sole shareholder. The payment was described as being “likely residual income and bonuses” for the Harry Potter films.

The actor argued he could pay capital gains tax on the sum at a rate of 10%, rather than income tax and national insurance at a top rate of 52%.

Recommended

In the ruling, tribunal judge Harriet Morgan dismissed Grint’s appeal and said the money “derived substantially the whole of its value from the activities of Mr Grint”, which was “otherwise realised” as income.

In 2019, the actor lost another, separate court case concerning a £1million tax refund.

In other news, Warner Bros. recently announced that Harry Potter will have the same sort of longevity as Batman, with multiple actors likely to play the titular wizard over the coming years.

It comes as a new Harry Potter spin-off series is in the works, which is slated to land in 2026. The show is expected to run for seven seasons, with each season adapting one of the books in J.K. Rowling’s series.